Legal & General Investment Product Designs

Role: Lead UX Writer

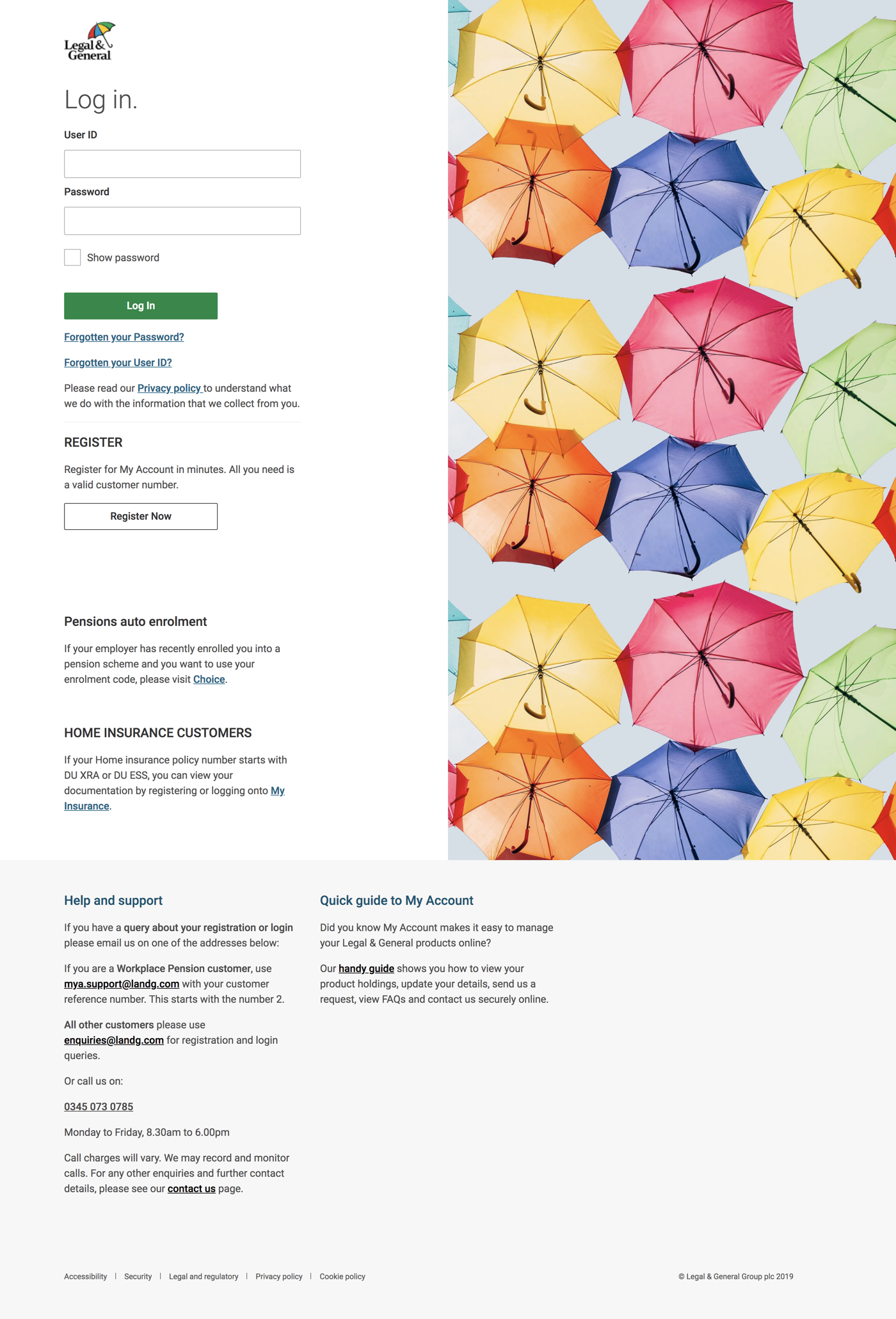

Project: Optimise an existing ISA product and create a new digital personal pension

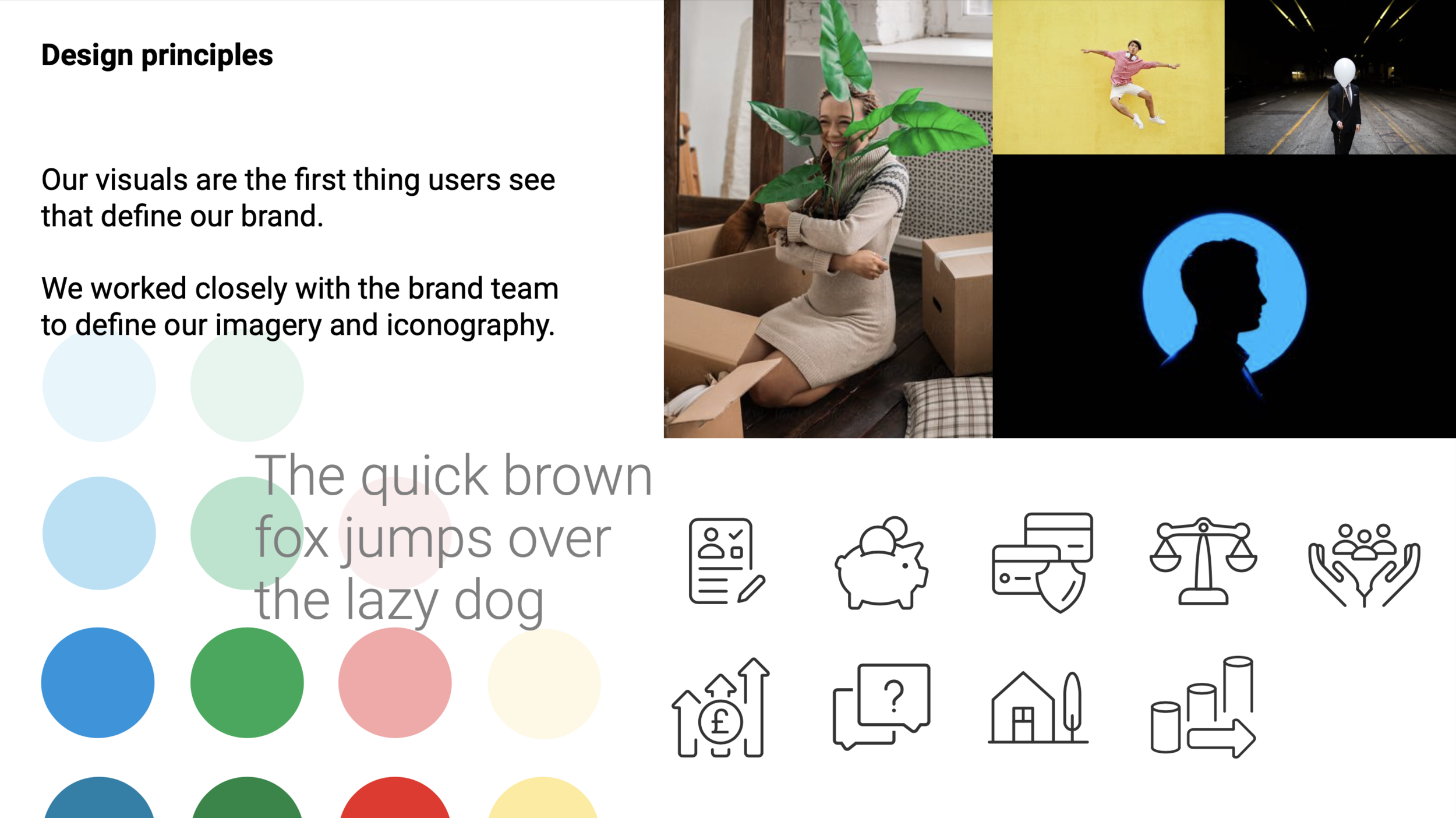

Skills: Design strategy, product development and design, content strategy, content design, copywriting

Overview

I was originally contracted to Smart, a strategic design agency, to work on 3 product experiences as part of L&G’s personal investing digital transformation:

Stocks and Shares ISA

Self-invested personal pension (SIPP)

Logged-in SIPP account portal (‘Wealth Wizard’)

During contract renewal talks, L&G decided to bring the talent in-house to also work on an overarching digital rebrand (visual and verbal).

Product 1: Stocks and Shares ISA

The challenge

Existing checkout journeys were not performing as desired:

Digital offering wasn’t responsive for mobile

Dropoff rates were around 20% at each step of the journey

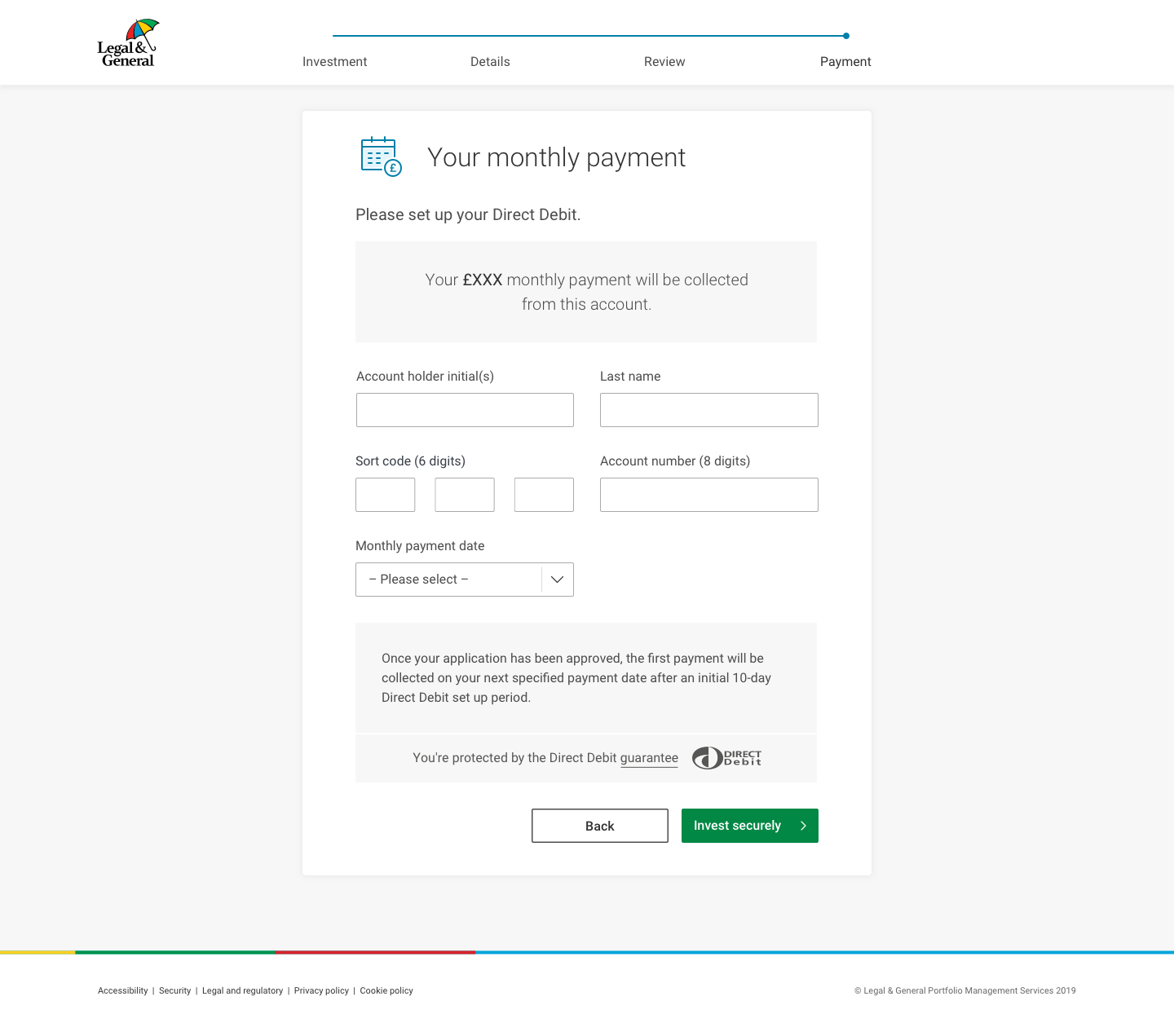

Due to technical constraints with a 3rd-party provider, payment screens needed to live at the end of the journeys

My role

As lead content designer on the project, I was directly involved in every aspect of the cross-functional design process:

User research and testing

Journey analysis and mapping

Content strategy and information architecture

Wireframing and prototyping

Product marketing content creation

The approach: user research and analysis

To determine the behavioural and informational pain points among our key user segments, I conducted 2 types of research alongside the lead designer:

Face-to-face user journey walkthroughs

Surveys surfaced in the live experience

We then developed an experience map to document our findings.

The approach: user personas

Our research also showed that a lack of investment understanding was one of the biggest barriers to entry. As a ‘do it yourself’ product, users often needed more direction and reassurance than the existing offering provided.

With this information, I decided to redefine our audience based on their levels of experience rather than demographics. We then developed 3 new user personas:

The approach: product concepting and development

As the existing product only catered for confident or skilled investors, we needed to devise an offering for new or inexperienced investors too.

The solution? An alternative ‘we do it for you’ service to sit alongside the ‘do it yourself’ offering.

I worked with the Product Owner and lead designer to develop the concept, deciding on a product that enabled users to invest based on their appetite for risk vs reward. Customers could choose the risk level they’re most comfortable with (lower risk, lower-medium, higher-medium or high). L&G would then recommend the most appropriate fund to invest in.

To kick off the design process, I then developed user flows from product discovery to investment confirmation.

The approach: design development

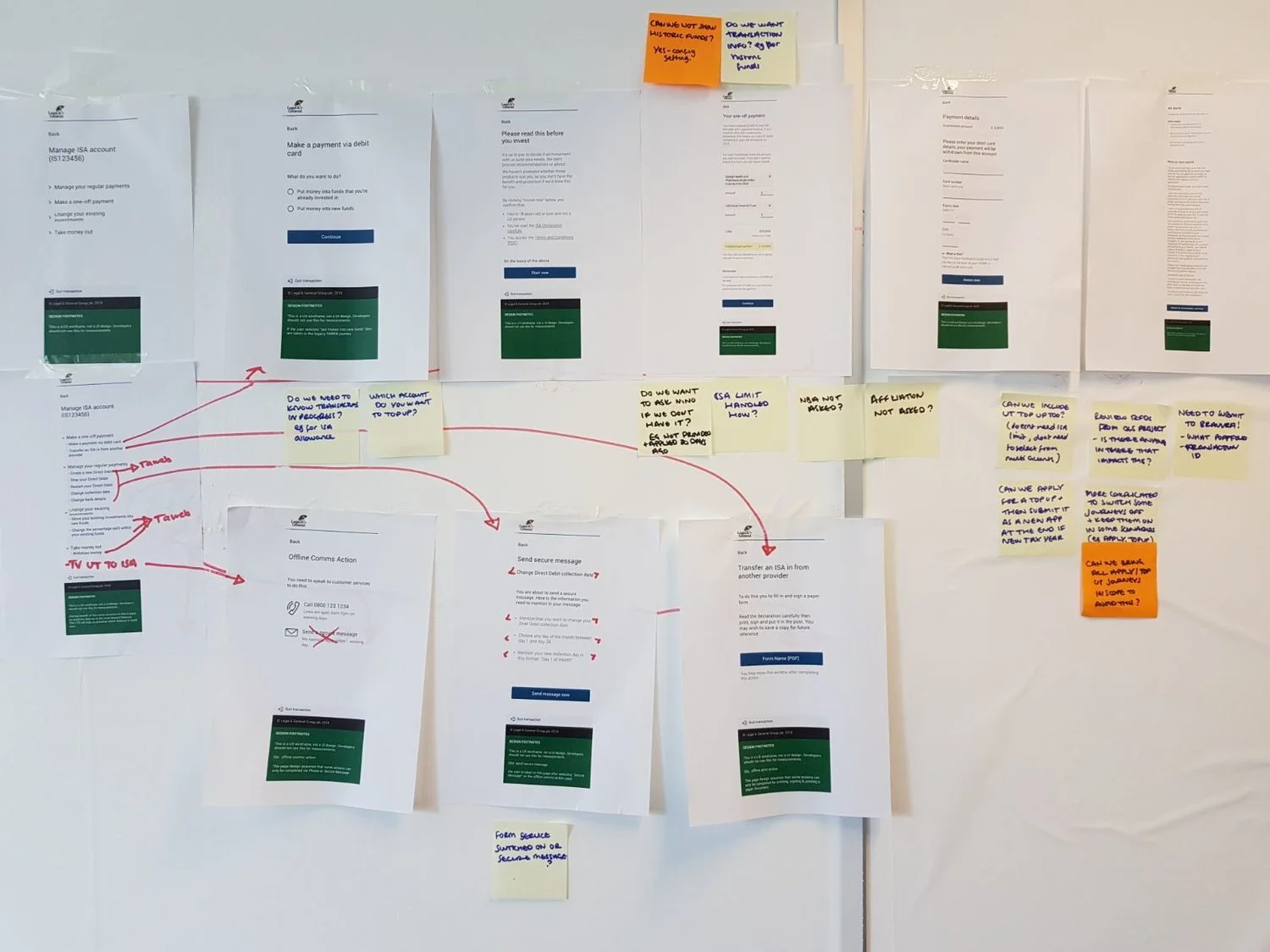

We stripped the existing product designs right back, building it from the ground up through an iterative process of wireframing, prototyping, testing and experience re-mapping.

For the new offering, we developed a frictionless 5-step journey enabling the user to choose their risk level and set up an initial investment amount.

I redesigned and rewrote all product content - turning complex technical data into information that resonates with total newbies and experienced investors alike.

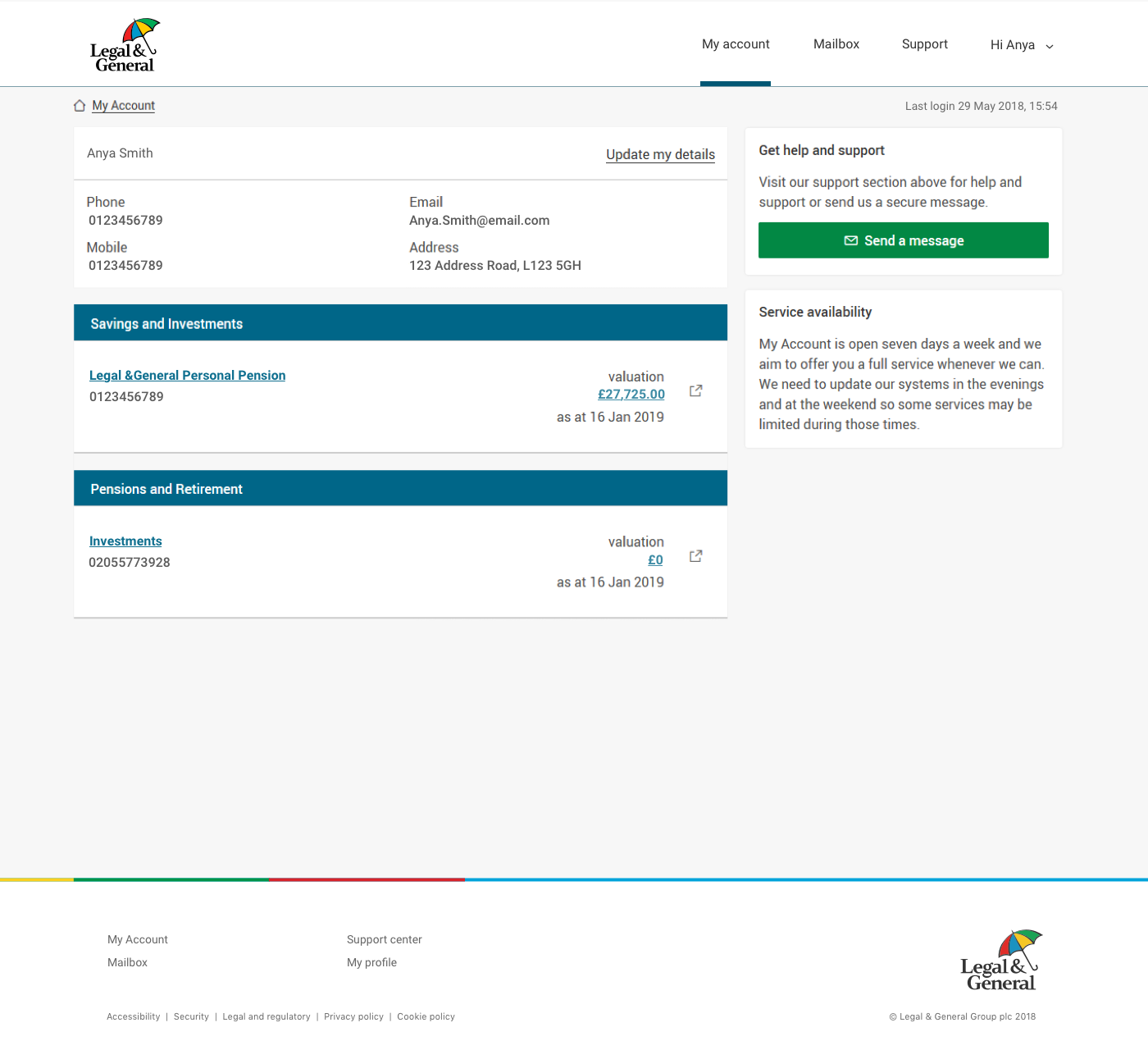

The impact

Key content design improvements:

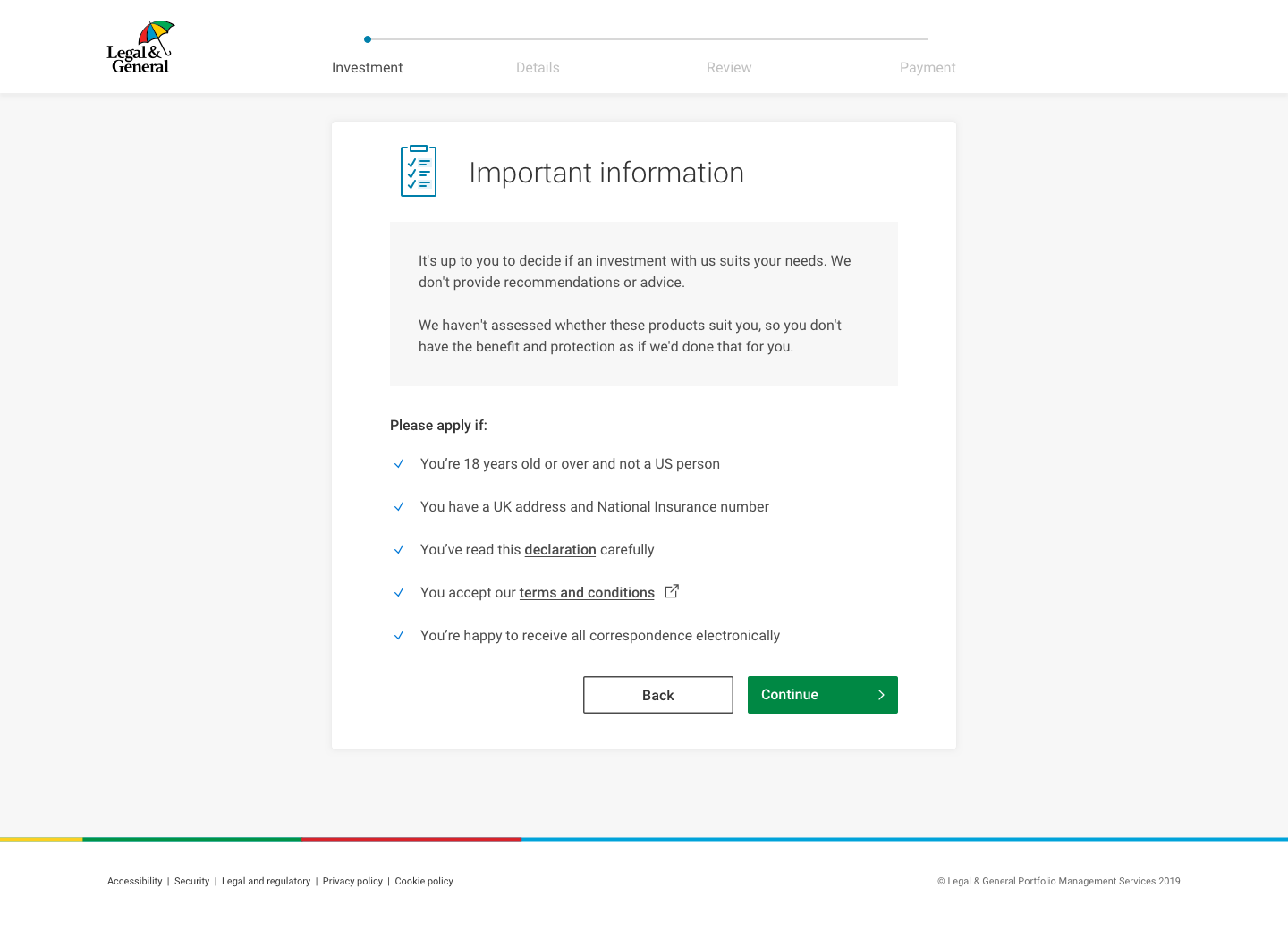

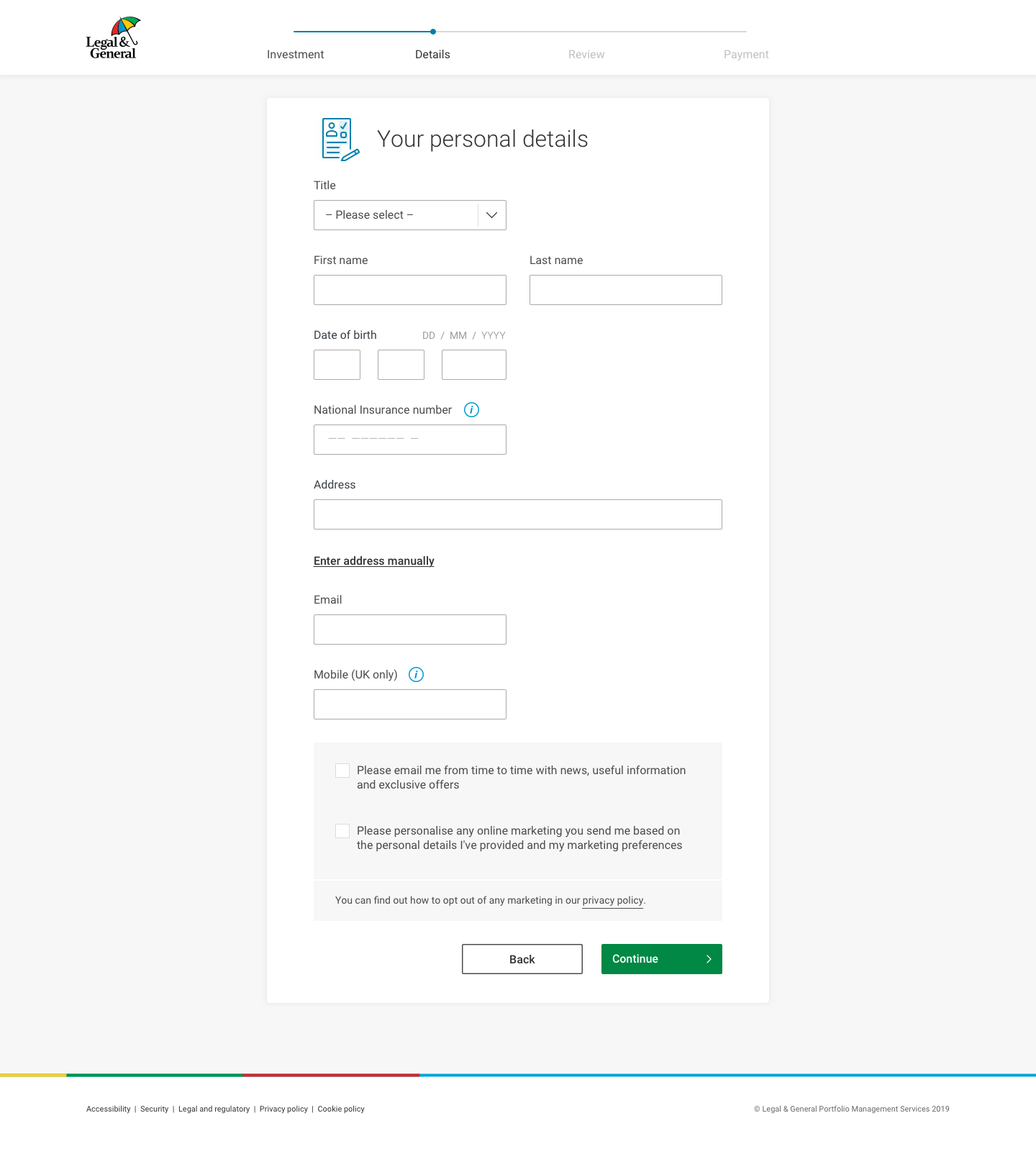

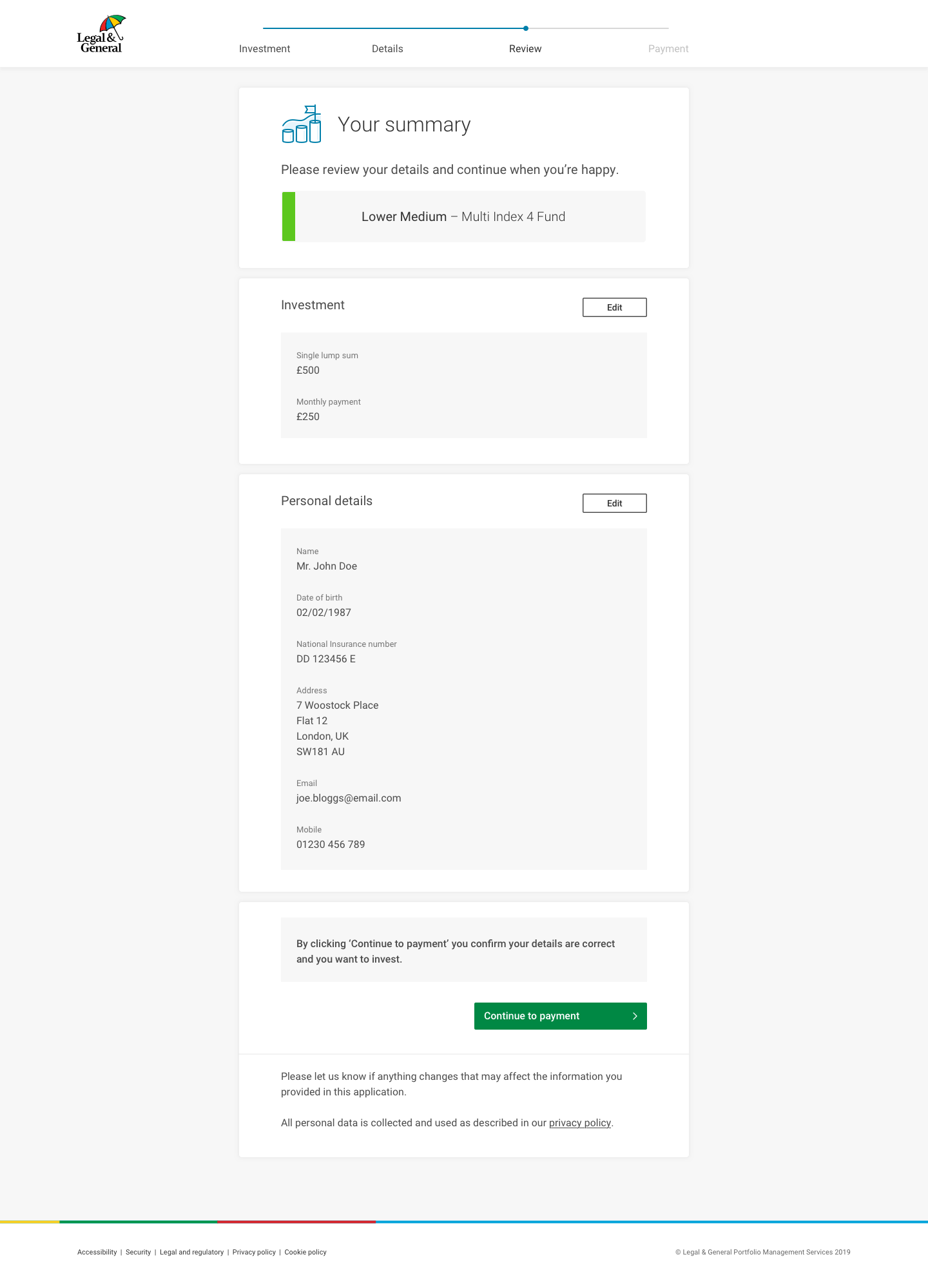

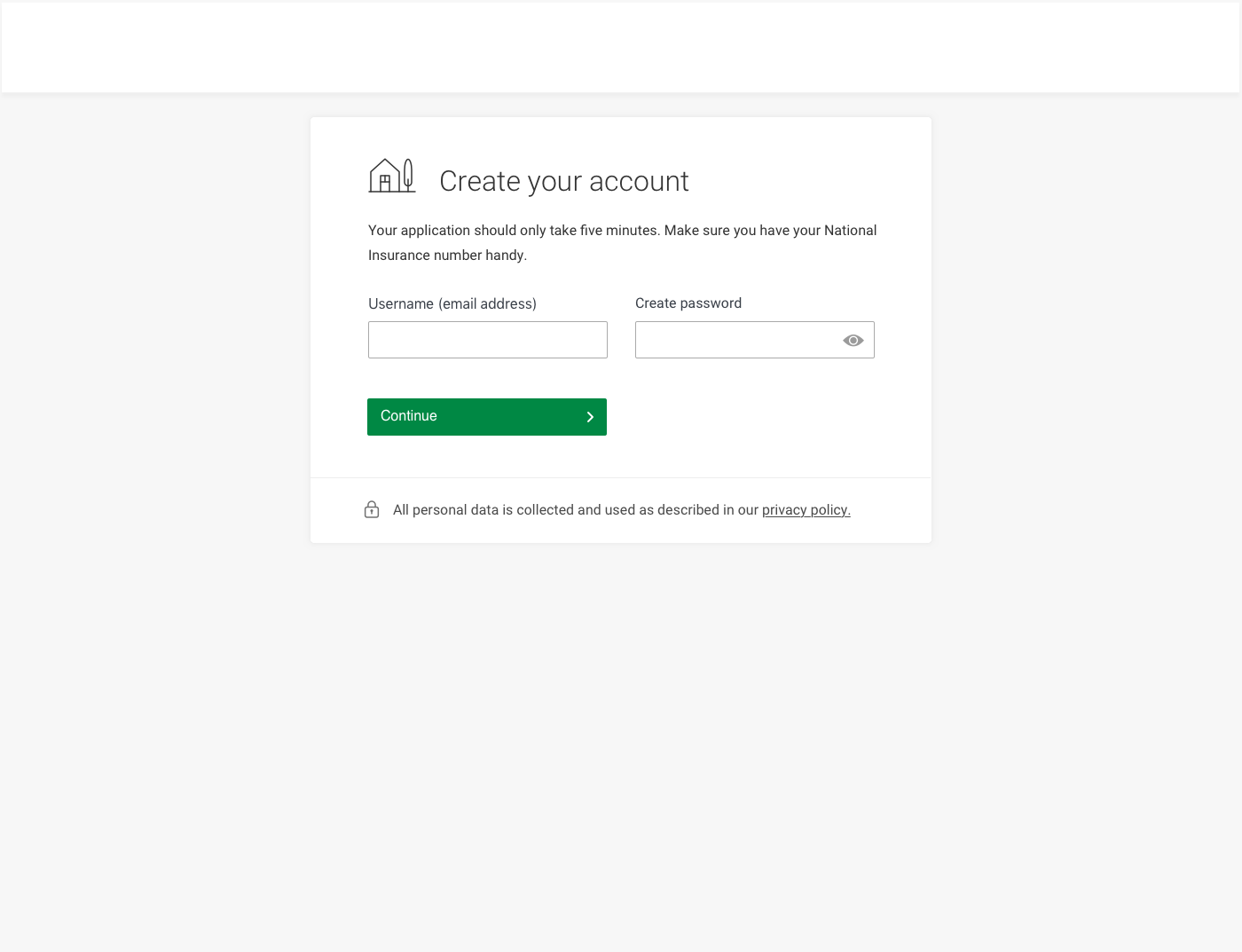

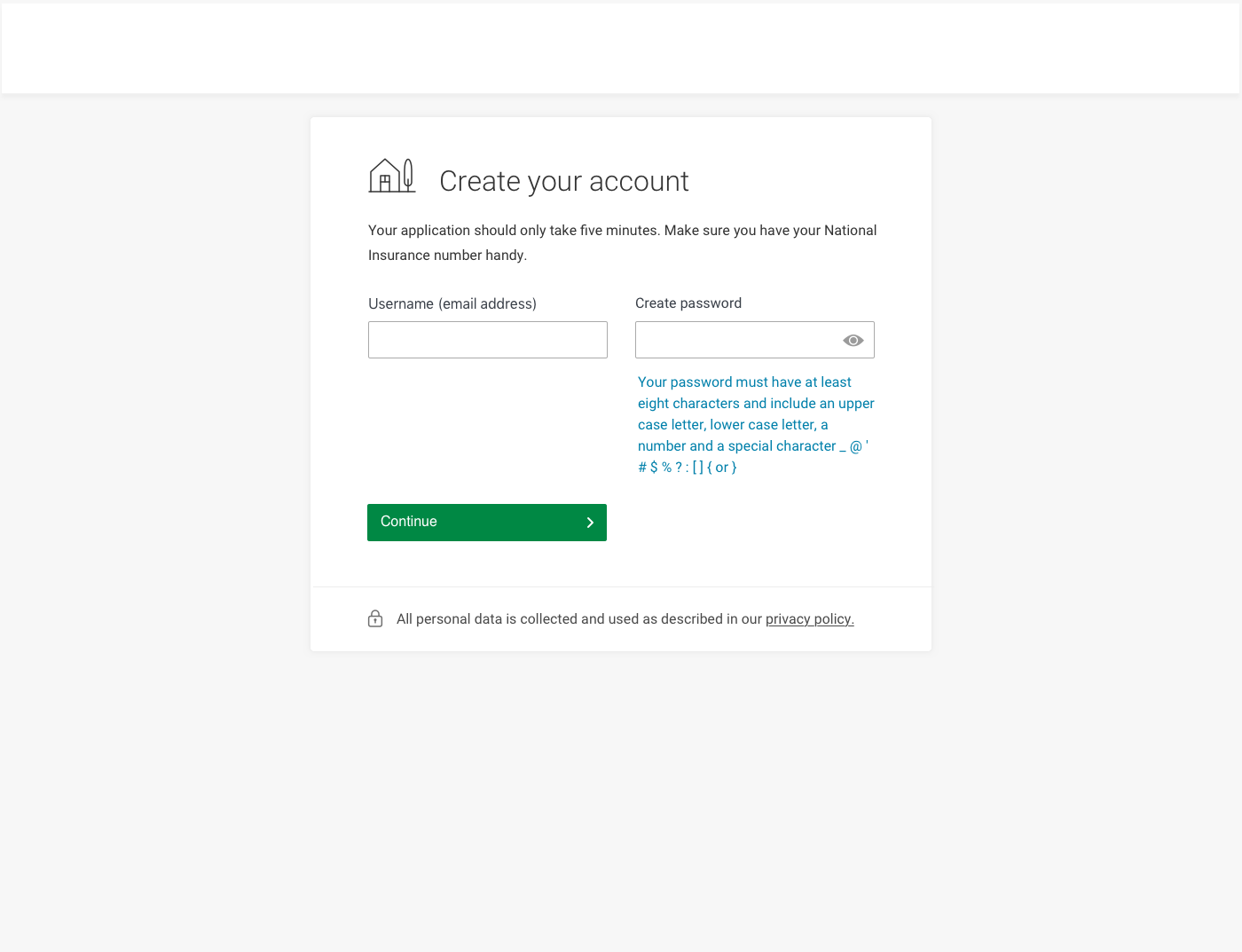

End-to-end content reduced by two-thirds

Congested 12-step journey condensed to nine

Supporting information moved into tooltips at key micro-moments

Key performance improvements:

60% increase in conversions per session

50% reduction to average drop off rate (from 20% to 10%)

Here’s the core checkout journey for the new risk-selection offering…

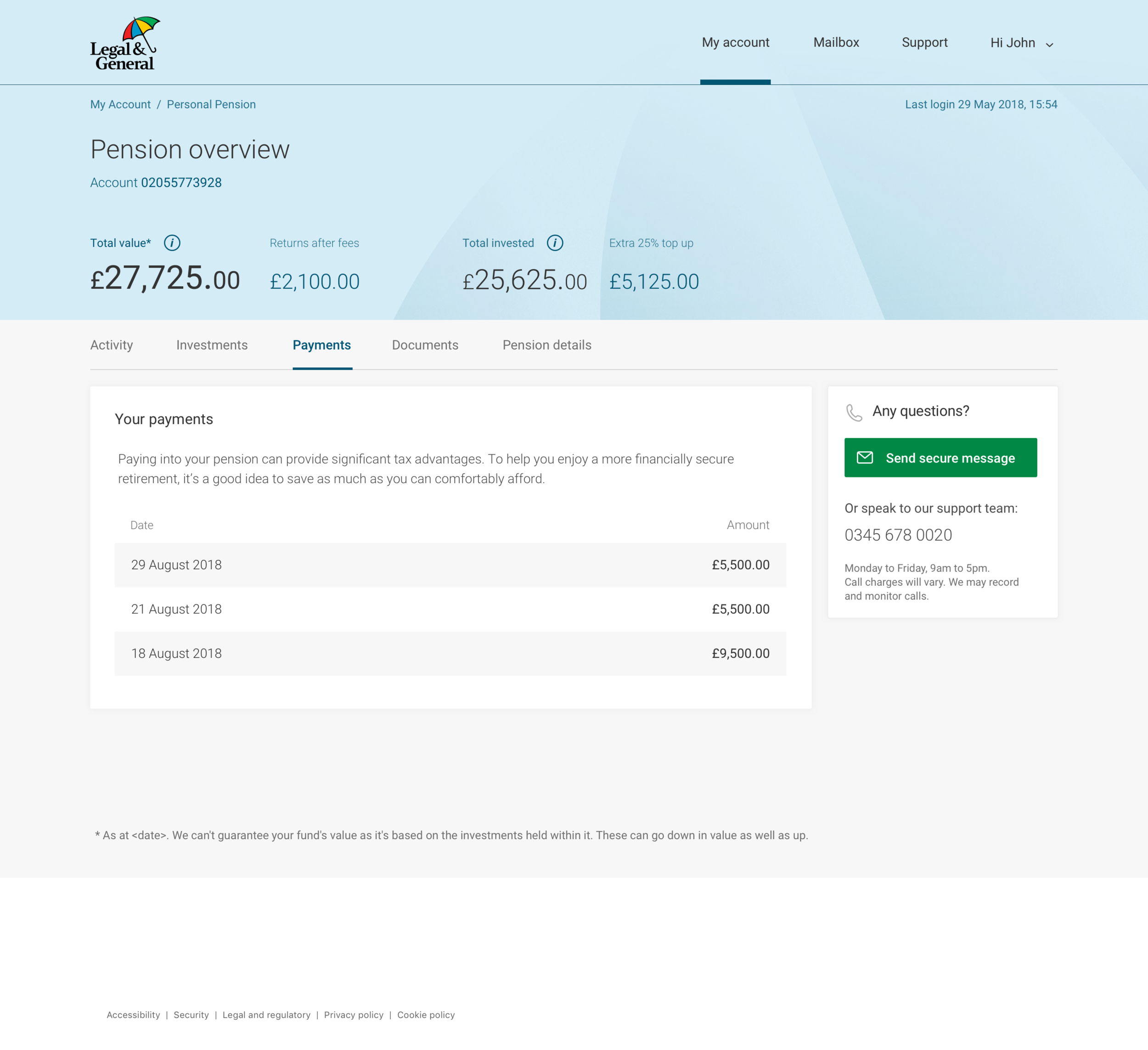

Product two: Self Invested Personal Pension (SIPP)

The challenge

L&G had previously only offered this type of pension via an offline fund management service. It was very technical, complicated, time consuming and aimed at experienced investors or wealthy households with an income over £250,000.

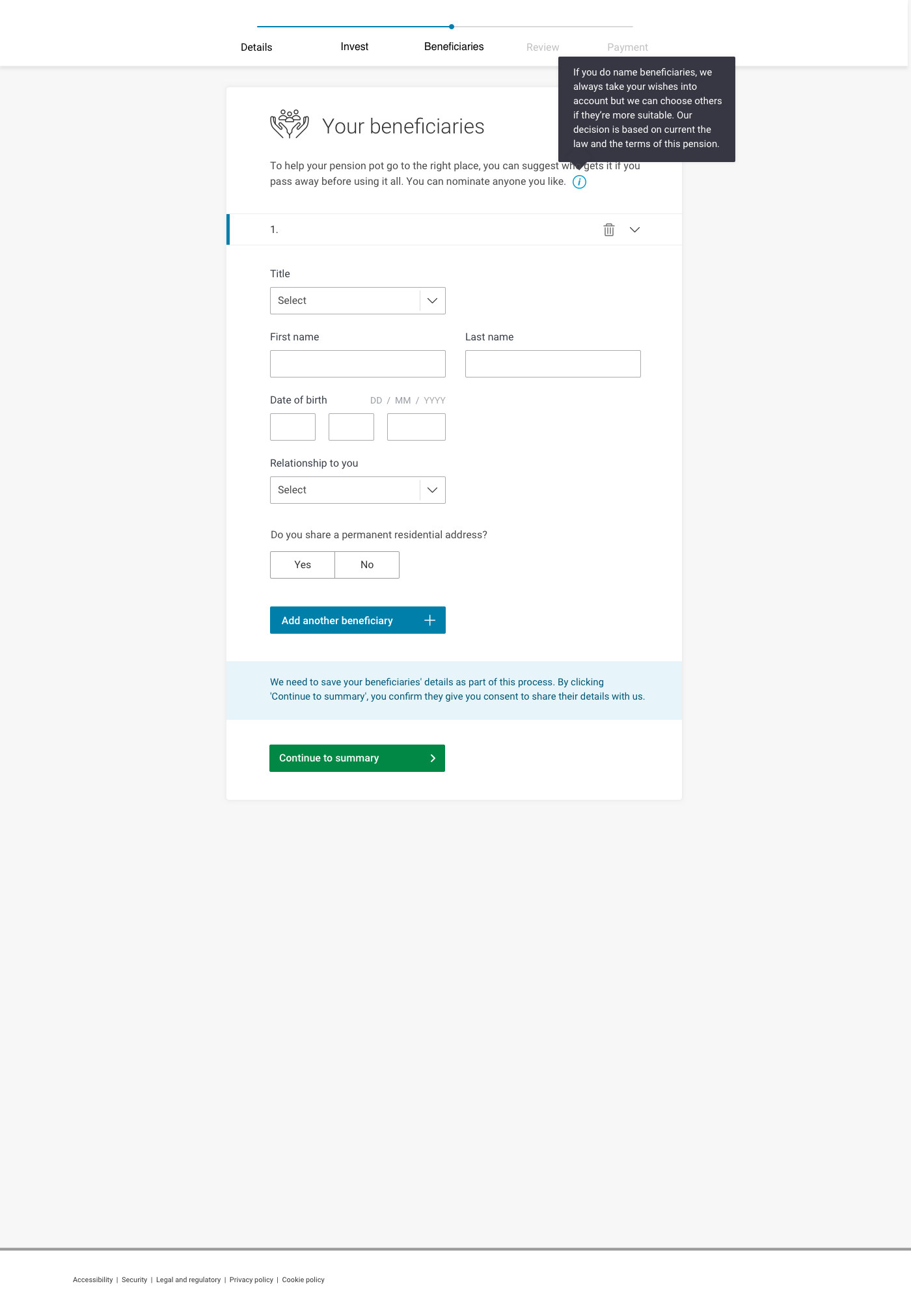

The digital offering needed to negate many friction points and emotional barriers - it had to be paper-free and accessible to a much wider audience.

As well as implementing a core checkout journey for this new product, I was also tasked with developing landing page content to drive traffic as well as a post-sale account management platform.

The approach: product concepting and development

We decided to develop our MVP proposition for the audience with the most potential for growth - inexperienced or less confident investors.

Folllowing the success of the Stocks and Shares ISA, we used the same ‘we do it for you’ concept based on different risk vs reward levels. The main difference being that, once a customer has chosen their risk level, L&G’s investment managers would then personally build the fund portfolio.

The approach: research, strategy and design

Please take a look at the slideshow and videos below for more details of the opportunity, cross-functional design process, messaging strategy and final content designs for both the core SIPP checkout journey and ‘Wealth Wizard’ account management tool.

The impact

Key content and design improvements:

Fully digital, no paper required

Fastest application in the UK market (from sign-up to set-up)

Instant investing (existing offering had 24-hour activation period)

Key performance improvements:

Cost of new business reduced by 80%

175% increase in SIPP conversions year-on-year